2024 Housing Market

The year 2024 has been an exciting time for the housing market in Michigan. With various factors influencing the real estate scene, this blog will provide an overview of the 2024 housing market, specifically focusing on buyers, mortgages, and a market update. Additionally, we will delve into the mortgage interest rates prevalent in Michigan during this period.

Buyers have played a significant role in shaping the housing market in 2024. With the millennial generation entering their prime home-buying years, there has been a surge in demand for both single-family homes and condominiums. Many young professionals and families have been actively searching for homes that cater to their lifestyle needs, such as proximity to urban centers, good school districts, and access to amenities.

However, the buyers' market has also posed a challenge for many individuals. The increased demand has led to a shortage of available properties, resulting in bidding wars and higher prices. As a result, potential buyers have had to be proactive, acting quickly when a suitable property becomes available. Working with a trusted real estate agent who understands the local market can greatly assist buyers in securing their dream homes amidst the competitive landscape.

Now, let's shift our focus to mortgages, a crucial aspect of home buying. In 2024, mortgage interest rates have remained relatively low, making it an advantageous time for buyers to enter the market. These low rates have presented an opportunity for potential homeowners to secure affordable financing options. Additionally, the availability of various mortgage programs catering to different financial situations has made homeownership more accessible to a wider range of buyers.

For those interested in the specific mortgage interest rates prevalent in Michigan during 2024, let's take a closer look. The average 30-year fixed mortgage rate in Michigan hovered around 3.5% to 4% throughout the year. This rate has been relatively stable, providing buyers with a sense of security in their budgeting and financial planning. However, it is important to note that these rates may vary depending on individual circumstances, credit scores, and lender policies. Consulting with a mortgage professional will help potential buyers understand the rates available to them more accurately.

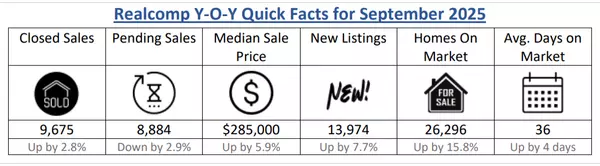

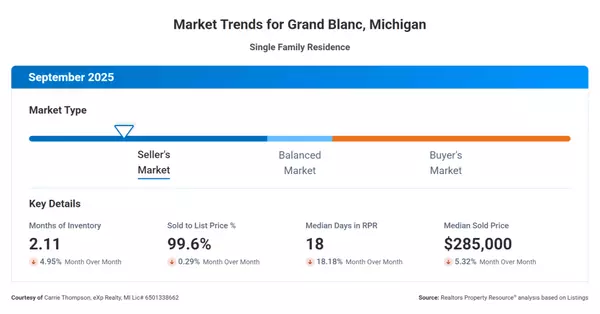

Lastly, let's discuss the market update for 2024. The Michigan housing market has experienced steady growth, with home prices appreciating at a moderate pace. This growth has been primarily driven by the strong demand from buyers and a limited inventory of available homes. However, it is worth noting that the market has shown signs of stabilization, with a slight increase in the number of homes being listed for sale in recent months. This trend indicates a more balanced market, offering buyers a broader range of options.

In conclusion, the 2024 housing market in Michigan has offered both opportunities and challenges for buyers. With a surge in demand from the millennial generation, buyers have had to be proactive and work closely with real estate agents to secure their desired properties. However, low mortgage interest rates and a growing inventory have provided buyers with advantageous conditions to enter the market. As we move forward, it will be interesting to see how the Michigan housing market continues to evolve and adapt to the changing needs of buyers.

Recent Posts

GET MORE INFORMATION