Moving to Lobdell Lake: Your Most Asked Questions Answered

Moving to Lobdell Lake: Your Most Asked Questions AnsweredWhat is it like to live on Lobdell Lake?Living on Lobdell Lake feels like having a vacation in your backyard year-round. The shimmering water, peaceful mornings, and friendly neighbors create a laid-back, welcoming atmosphere. Whether you’re

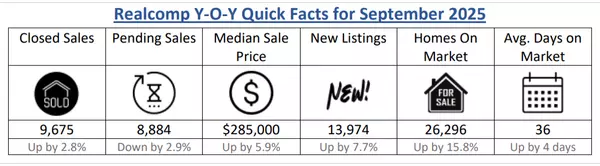

Moving to Genesee County: Everything You Need to Know

Moving to Genesee County: Everything You Need to KnowWhat Makes Genesee County a Great Place to Live? Genesee County, nestled in the heart of Michigan, offers a welcoming blend of small-town charm and big-city amenities. With its affordable cost of living, beautiful parks, and vibrant local culture,

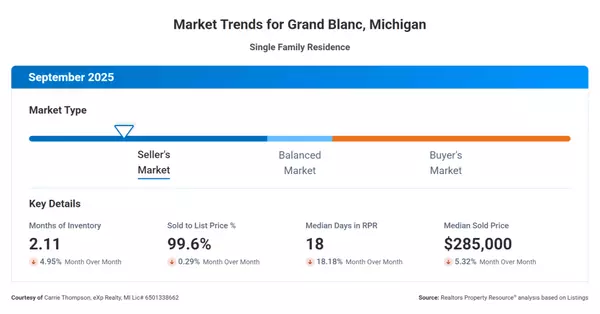

Moving to Grand Blanc: Your Essential Questions Answered

Moving to Grand Blanc: Your Essential Questions AnsweredWhy Consider Moving to Grand Blanc? Grand Blanc, Michigan, is a vibrant suburb known for its welcoming atmosphere, excellent schools, and scenic neighborhoods. Whether you’re seeking a family-friendly environment or a peaceful place to settle d

Recent Posts