How MSHDA's New Limits Transform Homeownership!

What Is MSHDA’s Down Payment Assistance Program?

MSHDA’s DPA program is designed to make homeownership more accessible by providing up to $10,000 to help cover down payments and closing costs for first-time homebuyers across Michigan.

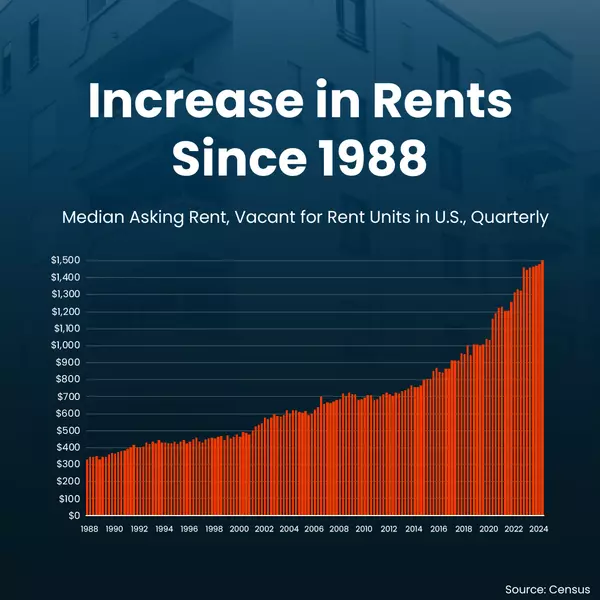

If saving for a down payment has been a hurdle, this program could be your ticket to stepping out of the rental cycle and into your dream home.

How Does the Down Payment Assistance Program Work?

Eligibility Requirements

- First-time homebuyer status (or haven’t owned a home in the past three years).

- Minimum credit score of 640 (or 660 for certain loan types).

- Household income must meet MSHDA limits, which vary by county and household size.

Loan Details

- 0% interest with no monthly payments.

- Repayment only when you sell or refinance the home.

Homebuyer Education

- Completion of a homebuyer education course from a HUD-approved housing counselor is required.

Why Is the New Purchase Price Limit a Big Deal?

In communities like Flint, Grand Blanc, Davison, and Fenton, the previous cap of $224,500 made it challenging to find suitable homes. With the new limit of $510,939, buyers can now consider properties with more space, updated features, and modern layouts that were previously out of reach.

Top Benefits of Using MSHDA’s DPA Program with the New Limit

- Access to More Homes: Explore homes in neighborhoods and price points you couldn’t previously afford.

- Stay Competitive: Higher price limits mean you can make stronger offers in today’s market.

- Keep More Savings: With up to $10,000 in assistance, you can cover costs without draining your bank account.

- Move into Your Dream Home: Upgrade to a property that truly fits your needs and lifestyle.

Who Can Benefit?

Whether you’re a first-time buyer, a young family needing more space, or someone looking for a fresh start, this program can help you achieve your goals. MSHDA’s higher purchase price limit ensures you don’t have to compromise on location, features, or size when choosing your home.

Why Act Now?

The housing market in Genesee County and surrounding areas is dynamic, and opportunities like this don’t last forever. If you’ve been waiting for the right time to buy, this is your moment.

Let’s Get Started!

Ready to explore your options and see if you qualify for MSHDA’s Down Payment Assistance program? Contact me today, and let’s work together to find your perfect home. With this program, we’ll make your dream of homeownership a reality while keeping more money in your pocket.

Recent Posts

GET MORE INFORMATION