What's Really Happening with Mortgage Rates?

Navigating the ever-changing landscape of mortgage rates can be a perplexing task, particularly for those residing in Genesee County, Grand Blanc, Fenton, and surrounding areas. With fluctuating reports claiming that mortgage rates are on the decline one moment and on the rise the next, it's understandable if you find yourself bewildered about the current state of affairs.

Understanding the Dynamics of Mortgage Rates

Mortgage rates are inherently volatile, subject to the whims of economic conditions, Federal Reserve decisions, and other influential factors. This volatility results in rates that may increase or decrease from one day to the next, mirroring the complexities of the global economy and financial markets. For residents of Genesee County, Grand Blanc, Fenton, and nearby locales, keeping an eye on these changes is crucial, especially when considering home financing options.

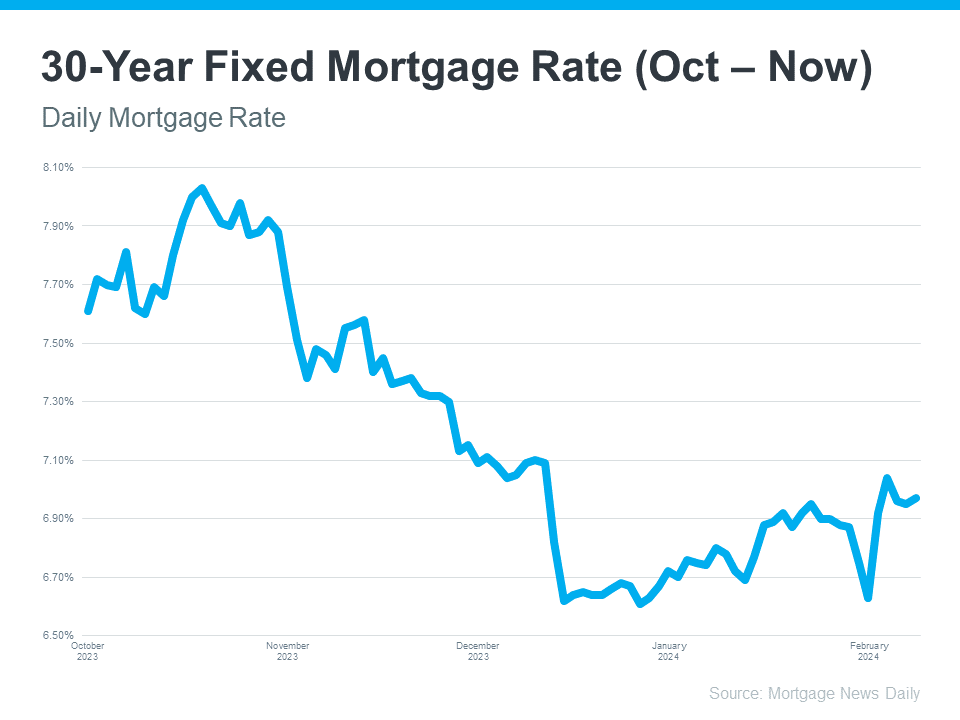

The fluctuation of mortgage rates is best visualized through historical data, such as that provided by Mortgage News Daily, which charts the ups and downs of the 30-year fixed mortgage rate. A glance at this data reveals a series of peaks and valleys, illustrating the unpredictable nature of mortgage rates over time.

Deciphering the Trends

When analyzing mortgage rate trends, the key is to adopt a broader perspective. Short-term observations may suggest an uptick in rates, but a comparison of current rates to those from a peak period, such as last October, often reveals an overall downward trend. This insight is invaluable for potential homebuyers in the Genesee County, Grand Blanc, and Fenton areas, signaling a potentially opportune time to secure a mortgage.

The overarching message is clear: while daily fluctuations in mortgage rates are inevitable, the general trend points towards a gradual decrease. This presents a silver lining for individuals looking to purchase homes in the current market. Experts concur that this downward trajectory may persist, offering a glimmer of hope for those aspiring to homeownership.

Your Trusted Guide in the Housing Market

For those navigating the complexities of the housing market in Genesee County, Grand Blanc, Fenton, and beyond, seeking professional guidance is paramount. Our expertise is tailored to demystify the process, providing clarity on mortgage rates and the broader real estate landscape. Whether you're pondering the timing of your home purchase or have queries about the housing market, we're here to assist.

In conclusion, while the journey through mortgage rate fluctuations can be daunting, understanding the broader trends offers a roadmap for prospective homebuyers. For personalized advice and insights into the Genesee County, Grand Blanc, and Fenton housing markets, connect with us. Together, we can navigate the intricacies of mortgage rates, ensuring you make informed decisions in your home buying journey.

Recent Posts

GET MORE INFORMATION